Home mortgage calculator with extra principal payments

360 original 30-year term Interest Rate Annual. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

All In One Interest Only Loan Calculator Financeplusinsurance

Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules.

. Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel xlsx xls or pdf format. The calculator updates results automatically when you change. ARMs usually come in 31 ARM 51 ARM or 101 ARM.

The home mortgage is a type of loan with a relatively low interest rate and many see mortgage prepayments as the equivalent of low-risk low-reward investment. Lowers monthly mortgage payments so that theyre more affordable. Assess any money that you can foresee needing in the future college tuition a vacation a newused car home repairs.

Down payment programs require homebuyers to be first-time buyers. Allows extra payments to be added monthly. Mortgage Amount or current balance.

2020 has been a record year for mortgage originations as many homeowners refinanced to take advance of low. How to Use the Mortgage Calculator. Connect with our friends at Clever Real Estate for a local agents expert opinion and a free.

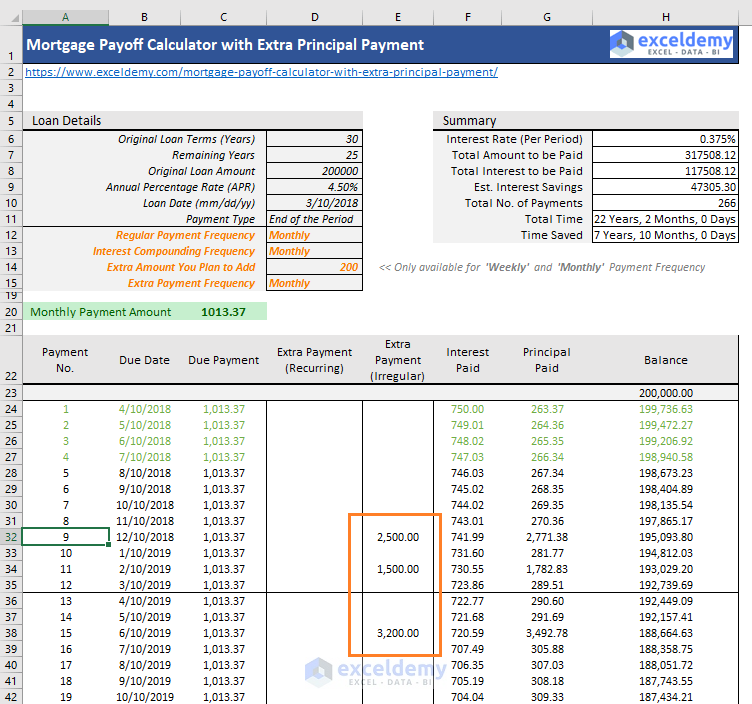

Our Excel mortgage calculator spreadsheet offers the following features. Experienced loan officer who understands the housing market and is prepared to go the extra mile to guide you through the process and secure the best mortgage rate available. Pay this Extra Amount.

This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and HOA fees. Conforming Fixed-Rate estimated monthly payment and APR example. It also calculates the sum total of all payments including one-time down payment total PITI amount and total HOA fees during the entire amortization.

Make payments weekly biweekly semimonthly monthly bimonthly quarterly or annually. Consider how long you plan on living in the home. This loan calculator is written and maintained by Bret Whissel.

A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors. Use the Extra Payments Calculator to understand how making additional payments may save you money by decreasing the total amount of interest you pay over the life of your home loan. Refinancing your mortgage means replacing an existing home loan by taking out a new one with your current lender or a different.

This means higher mortgage payments once interest rates increase. Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier such as extra payments bi-weekly payments or paying back altogether. Microsoft Excel Mortgage Calculator Spreadsheet Usage Instructions.

Brets mortgageloan amortization schedule calculator. Use our extra mortgage payment calculator to see how fast you can pay off your mortgage with additional monthly payments. See Brets Blog for help.

Mortgage calculator - calculate payments see amortization and compare loans. Our calculator includes amoritization tables bi-weekly savings. Total Tax Insurance PMI and Fees.

Our mortgage calculator helps you estimate your monthly mortgage payments. A Roth IRA or a 401k. Low- and middle-income homebuyers.

Home Value - This is the. The mortgage amortization schedule shows how much in principal and interest is paid over time. The home loan calculator accounts for mortgage rates loan term down payment more.

Number of Regular Payments. Offers home loans with below-market interest rates down payment assistance and a mortgage credit certificate tax credit program. You can also try reducing PMI by reappraising or remodeling your home.

After the initial teaser period the rate changes annually. In just 4 simple steps this free mortgage calculator will show you your monthly mortgage payment and produce a complete payment-by-payment mortgage amortization schedule. See how those payments break down over your loan term with our amortization calculator.

You can also see the savings from prepaying your mortgage using 3 different methods. Since creating this spreadsheet Ive created many other calculators that let you include extra mortgage paymentsThe most advanced and flexible one is my Home Mortgage Calculator. But you can also calculate mortgage payments monthly.

To achieve this you can make extra payments regularly or a lump-sum payment toward the mortgage principal to reach that 20 sooner. Calculate loan payment payoff time balloon. To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way.

Enter your loan information and find out if it makes sense to. Estimated monthly payment and APR calculation. Before you begin making extra principal payments on your mortgage its best to consider your overall financial goals.

Making extra payments can drastically reduce your loan term and save you a tremendous amount on interest charges. A 225000 loan amount with a 30-yea r term at an interest rate of 3375 with a down-payment of 20 would result in an estimated principal and interest monthly payment of 99472 over the full term of the loan with an Annual Percentage Rate APR of 3444. After the COVID-19 crisis the FOMC dropped the Fed Funds Rate to zero and issued forward guidance suggesting they would not lift rates through 2023.

Home Affordable Modification Program. The CUMIPMT function requires the. Shows total interest paid.

Calculate the difference in total interest paid on a mortgage loan when making additional monthly payments. Then examine the principal balances by payment total of all payments made and total interest paid. Check out the webs best free mortgage calculator to save money on your home loan today.

For instance if you take a 51 ARM the rate starts off low and you pay the same mortgage payments for the first five years. For Excel 2003. In addition to making extra payments another great way to save money is to lock-in historically low interest rates.

Four alternatives to paying extra mortgage principal.

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage Calculator With Extra Payments Payment Schedule

Mortgage Payoff Calculator With Line Of Credit

Mortgage Payoff Calculator With Extra Principal Payment Free Template

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Free Interest Only Loan Calculator For Excel

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortizatio In 2022 Mortgage Amortization Calculator Amortization Schedule Amortization Chart

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage With Extra Payments Calculator

Extra Payment Mortgage Calculator For Excel

Biweekly Mortgage Calculator

Early Mortgage Payoff Calculator Be Debt Free Mls Mortgage

Excel Mortgage Calculator Spreadsheet For Home Loans Buyexceltemplates Com